Tariff codes for homeware products

Topics

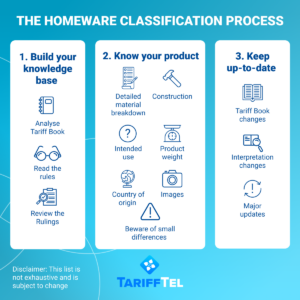

The world of homeware products is as diverse as it is vast, encompassing everything from kitchen utensils to furniture and beyond. Yet, for businesses engaged in international trade, the classification of these items and the assignment of the correct tariff codes can pose significant challenges. We understand the complexities inherent in this process and our unique TariffTel solution has been developed to classify even the most complex of homeware products. It is tried and tested by our customers who are leaders in retail and rely on accurate classification to remain compliant with trade regulations.

Here, we look at what things to consider when classifying homeware products and a complex product example which requires extra consideration.

The maze of product diversity

Homeware products come in a myriad of shapes, sizes, materials, and functions, making their classification a daunting task. From ceramic dinnerware to upholstered furniture, each item presents unique characteristics that must be carefully analysed to determine the appropriate tariff code. Furthermore, the evolving nature of homeware design and innovation adds another layer of complexity, requiring businesses to stay abreast of the latest product developments to ensure accurate classification. For example, even a simple product such as a wooden photo frame requires specific knowledge regarding whether the wood used is Tropical or not, and beyond that, if the Tropical wood is included in a specific list in the additional chapter notes.

ceramic dinnerware to upholstered furniture, each item presents unique characteristics that must be carefully analysed to determine the appropriate tariff code. Furthermore, the evolving nature of homeware design and innovation adds another layer of complexity, requiring businesses to stay abreast of the latest product developments to ensure accurate classification. For example, even a simple product such as a wooden photo frame requires specific knowledge regarding whether the wood used is Tropical or not, and beyond that, if the Tropical wood is included in a specific list in the additional chapter notes.

The classification of homeware products is not solely dependent on their physical attributes but also on complex regulatory guidelines and trade policies governing international commerce. Different countries and regions may have their own classification systems and rules, further complicating the process for businesses engaged in cross-border trade. Failure to adhere to these regulations can result in customs delays, fines, or even legal repercussions, underscoring the importance of accurate classification.

Harnessing technology for precision classification

In the face of these challenges, technology emerges as a valuable tool for businesses seeking to streamline their customs classification processes and gain greater accuracy in tariff codes. A customs classification solution like TariffTel allows retailers to classify by product attribute and material composition, using data directly from your suppliers who know your products best. This enables businesses to assign the correct tariff codes with unprecedented accuracy and efficiency.

TariffTel holds thousands of item types and provides an easy-to-read breakdown of the key points relating to the classification of a given homeware product. It also offers guidance in the form of clarifying information for products which are particularly complex from a classification perspective.

A complex example of a homeware classification with hidden pitfalls

A plant pot would seemingly be a simple classification, however, there are details which will change the code generated for this product, as well as its duty rate. Within TariffTel we have separated plant pots into four item types, based initially on whether the plant pot is made using Plaited or Wickerwork materials/construction, as this will change whether the product is classified in Heading 4602 or not.

For this example, this plant pot is made of Base Metal – Aluminium – Not Cast and is Not Hand-made, so, we would choose a “Not Plaited/Wickerwork” Item Type. The next attribute to decide on is if the product is “Decorative or Ornamental” or “Functional.” Here, the clarifying information attached to each item type explains the meaning of these terms, and we explain that “Functional” refers to a plant pot which has drainage hole/s at the base and is used as a functional plant pot. Whereas “Decorative or Ornamental” means a plant pot that does not have these drainage hole/s, and, therefore, is not used as a functional plant pot, but serves a decorative or ornamental purpose. These two options determine whether the plant pot will be classified to Heading 8306290000 – Ornamental Articles of Base Metal – Duty Rate 0.00%, or to Heading 7616999099 – Other Articles of Aluminium – Duty Rate 6.00%.

The difference between whether a product is “Functional”, or, “Decorative or Ornamental”, is not explained within the Chapter or Section Notes, which are the most easily accessible pieces of guidance within the tariff, nor is that difference explained in the Explanatory Notes, which are not generally accessible, but hold a much greater level of granular detail on how to classify. Instead, this is information we have researched from Binding Tariff Information rulings, Advanced Tariff Rulings, and CROSS (US binding rulings), which have allowed us to understand how the higher authorities interpret the tariff book for these products.

This is just one example of a product which has hidden levels of complexity that are not easily understood when just using the tariff book. There are many other products which are equally as complicated and where the rules to accurately classify are held elsewhere.

Ensuring compliance and efficiency

With access to up-to-date tariff codes and real-time regulatory updates, TariffTel customers can confidently navigate the complexities of homeware classification while minimising the risk of supply chain disruption and potential penalties. Moreover, by streamlining classification processes, TariffTel can enhance operational efficiency, allowing businesses to focus their resources on driving growth and innovation.

Interested in how to classify food products as well as homewares? Read our recent food classification blog to see more complexities in classification.

Other Useful Resources

The end of US de minimis – what’s next?

Significant trade news from the US this month with President Trump signing into law the “One Big Beautiful Bill” (OB...

How to avoid overpaying customs duty & classify smarter

Your how-to guide to tariff code accuracy If you handle HS, HTS, tariff or commodity codes, this how-to guide...

Incorrect tariff codes are draining your bottom line

Getting tariff codes right is the fastest way to boost margins Every year, businesses quietly haemorrhage pro...