TariffTel is now ISO 27001 certified

Your product data, protected to the highest standard. We’ve achieved ISO/IEC 27001:2022 certification, the internat...

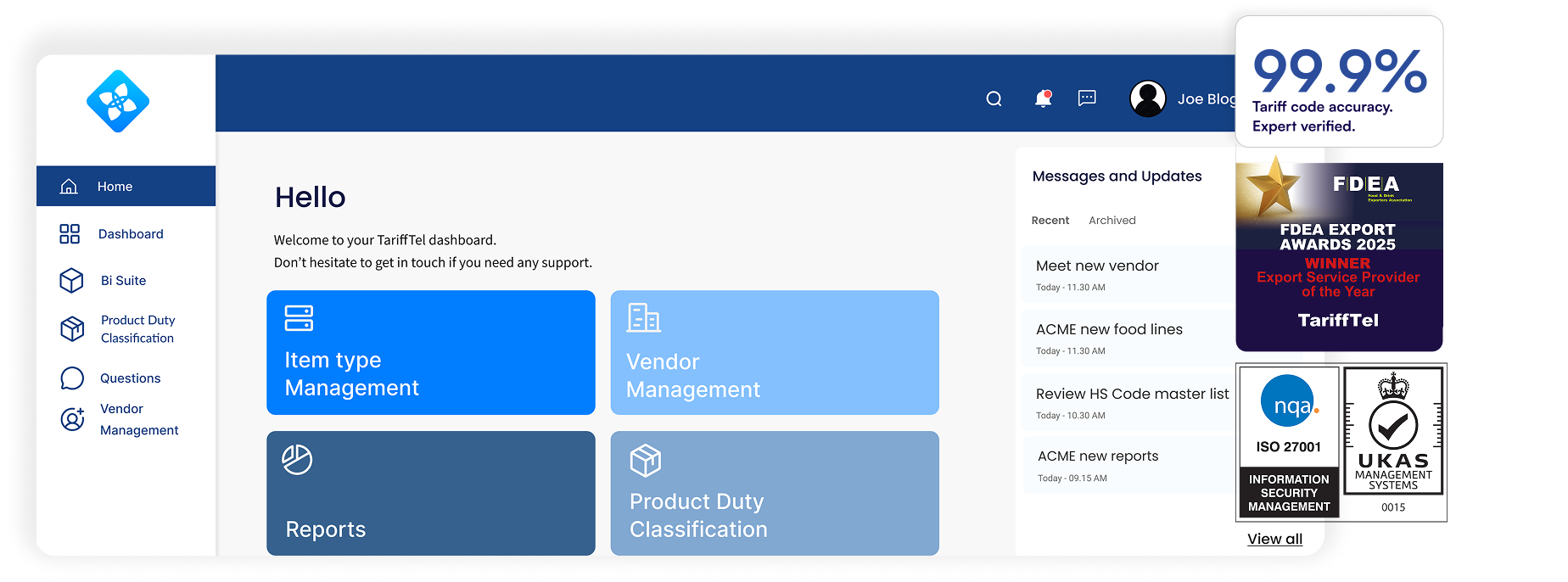

99.9% tariff code accuracy. Expert-verified. Audit-ready.

No more overpaying duties, fines or shipment delays. Turn classification into a strategic advantage.

One central platform for complete tariff code compliance and visibility.

These businesses rely on TariffTel everyday for accurate tariff codes

Stop overpaying duties. Stop running serious compliance risk.

Grow your business with one central platform for all product data.

With accurate HS codes, you benefit from:

An uninterrupted and quick moving supply chain

Compliance with trading rules & regulations

Assurance you pay the right duty amount

Customs classification solutions like TariffTel make assigning accurate tariff codes for products easy and quick. You improve compliance standards, receive a full audit trail of your products and keep up-to-date with code changes.

With TariffTel, you benefit from the highest standard in customs classification. You’ll soon see why it matters.

TariffTel combines fast automation with expert verification. 99.9% accurate tariff codes, verified by best-in-class experts, updated immediately when rules and regulations change.

No spreadsheets. No guesswork. No choosing between being fast or being right. No compromises.

The regulatory landscape is shifting faster than anyone can manually track. Spreadsheets and legacy systems can’t keep pace.

TariffTel flags what others miss. Misclassified products, duty exposure, Free Trade Agreement eligibility leading to preferential duty rates. We monitor every change and alert you before it affects your shipments.

The product data TariffTel captures underpins emerging requirements like Digital Product Passport (DPP), CBAM reporting and EUDR traceability.

Classify correctly today, be compliant-ready tomorrow.

Our technology drives the speed. Our best-in-class experts drive the 99.9% accuracy.

Every tariff code, every rule, every classification decision is determined, stored and maintained by our classification specialists with years of experience, who understand global trade compliance inside and out. Our platform can determine your tariff codes in seconds, not minutes. For complex cases or grey areas, our team takes the time to get it right.

Confidence in every classification.

TariffTel goes beyond classification. Know the full landed cost of your products and use that insight to make better sourcing, design and packaging decisions.

Pay exactly the right amount of duty, not a penny more. Identify suppliers in markets with preferential tariffs.

One secure platform for every product. Turn classification into margin.

Recognised where accuracy matters most.

The food & drink sector is one of the most complex sectors to classify. Ingredients, processing methods, origin rules and frequent regulatory changes leave no room for error.

TariffTel was recognised by the Food & Drink Exporters Association (FDEA) as Export Service Provider of the Year 2025 for delivering classification accuracy in a sector where the margin for error is zero.

Proven accuracy. In the toughest environments.

Accurate tariff codes require secure data.

Classification runs on detailed product information. Materials, suppliers, specifications, pricing. As regulations like CBAM, EUDR and Digital Product Passport expand, that data must be protected to the highest standard.

TariffTel holds ISO/IEC 27001:2022 certification, the internationally recognised gold standard for information security management, independently audited by NQA across our UK and EU operations.

99.9% accurate. And secure.

Book a 20-minute demo tailored to your product portfolio. No obligation, no jargon — just a clear view of how TariffTel works with your data.

Your product data, protected to the highest standard. We’ve achieved ISO/IEC 27001:2022 certification, the internat...

That question is costing you more than you think. It sounds reasonable. The code worked last time. Your broke...

And what it’s costing you... Tariff codes might look like a routine administrative step when you’re preparing goo...