How to classify complex food products for customs

Topics

From gourmet delicacies to everyday staples, the diversity within the food industry presents a complex task when assigning the correct tariff codes for customs classification. Classifying food products requires both a meticulous attention to detail and a comprehensive understanding of regulatory frameworks and product characteristics. Get it wrong, and the consequences can be severe leading to fines, shipment delays and even legal action which every business wants to protect against.

In this blog we explain what steps food retailers and manufacturers can take to introduce a streamlined and compliance-first approach to food classification. We look at learnings from our customer M&S who we have supported with food classification for several years, and also explore the classification process we go through on two product examples.

Understanding the complexity of food classification

The sheer variety of food items, coupled with the intricate nuances of international trade regulations, often complicates the  classification process when it comes to food.

classification process when it comes to food.

The following factors all play a crucial role in determining the correct tariff code:

- Ingredient composition

- Processing methods

- Packaging

- Intended use

Having worked closely with M&S and their food department for several years, we understand how seasonal events such as Christmas and Easter can introduce even more complexity when getting food products on shelves in time for celebrations. Does anyone remember the M&S white chocolate carrot made from real gold leaf? Yes, we even classified that!

The margin for error is small when it comes to food products.

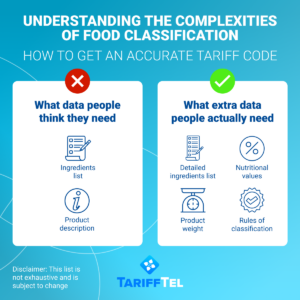

Variations in the product composition can shift a classification within a Heading or move it across Chapters. What makes things more complicated with food products is that the information used to determine classification is often not held in one location, but instead across multiple data sources with differing levels of accessibility.

When you do have all the information needed to classify a food product, often there is further difficulty due to the differences in  interpretation of the tariff between regions. This can lead to the same product having a different tariff code based on the import region which in turn makes it challenging for businesses to ensure compliance across multiple markets.

interpretation of the tariff between regions. This can lead to the same product having a different tariff code based on the import region which in turn makes it challenging for businesses to ensure compliance across multiple markets.

Further complication also can arise from the sheer amount of information that must be consulted in order to be fully compliant. Add in the fact that the data is not held in one central, freely accessible location, but instead across multiple, disparate sources, some of which are only accessible for a fee, and it can be difficult to be certain of your classification.

This is where it becomes crucial that the team classifying your goods has a thorough understanding of the food regulatory environment, or you have access to classification experts like our TariffTel specialists, who can provide much needed advice and support.

Two examples of classifying food products

Example One: A large, solid chocolate egg, filled with fruit and nuts.

Classifying products requires an understanding of when certain products are precluded from headings that might sound correct. A product may sound like it fits perfectly to a code, however, within the section/chapter notes, due to a small feature, it may be precluded. Further increasing this difficulty is the fact that these rules and restrictions are held in different places and formats, and require work to research and understand them.

For example, Heading 1806 covers “Chocolate and other food preparations containing cocoa”, and, for this example, we would skip over the first three subheadings which do not fit, selecting “Other” instead. The first option is “Chocolate and Chocolate Products,” followed by “Chocolates (including pralines), whether or not filled”, and, within the chapter notes, it explains that for the codes within this subheading, 1806.9011.00 and 1806.9019.00, they do not include products solely of one type of chocolate. Our product is only of one type of chocolate, and is therefore precluded from this heading, however, if this product did contain more than one type of chocolate, it would still not be accepted under this subheading. The EU Explanatory Notes explain that these subheadings only cover products “capable of being consumed in a single mouthful” and given the size of our product, it does not meet this requirement.

Accepting that this product is excluded from “Chocolates (including pralines), whether or not filled” we will look at the “Other” subheading which follows. There are two options available:

- “Filled” and “Not Filled,” and while our product is filled with fruit and nuts, this would not be accepted under the “Filled” subheading

- The WCO Explanatory Notes define “Filled” as containing a filling such as a nougat, caramel, cream, fruit paste and similar, while excludes products which are solid chocolate with cereal, fruit or nuts embedded throughout the chocolate

- This Explanatory Note is referring to a different Subheading, 1806.31, but in a separate EU Explanatory Note, it is applied mutatis mutandis to the heading we are looking at for this product.

Within TariffTel we have researched and understood these areas and built our Item Types in a way that is easily understandable for users, with clarifying information that guides them in their selection, removing the need for unnecessary hours of research or accidental misclassification.

Example Two: The difference between a beef lasagne ready meal, and a beef Bolognese ready meal with spaghetti pasta

There are many rules that surround the classification of food products in the tariff, particularly relating to the preparation of meat. Here we highlight an exception to the broadly understood rule that a product is generally classified as a ‘preparation of meat’ if it contains greater than 20% by weight of meat.

- If we were to classify a spaghetti Bolognese ready meal, which has greater than 20% cooked beef, it would be considered a ‘preparation of beef’ under tariff code 1602.5095.90 – duty rate 16.60%

- However, if the percentage of beef in the product dropped below 20%, the classification would likely fall to the pasta as the essential character following the beef, generating the code 1902.3090.90 – duty rate 6.40%+9.70EUR/100KG.

Conversely, if we looked at a beef lasagne ready meal:

- The percentage of beef is not considered and instead this would be classified as a stuffed pasta under heading 1902.2091.90 – duty rate 8.30%+6.10EUR/100KG

- Part of this information is included in the Chapter notes to heading 1902 stating that “stuffed products of heading 1902” are excluded from the “Greater than 20% meat” rule, however, what is not included is that the WCO Explanatory Notes highlight, stuffed pasta “may be fully closed (for example, ravioli), open at the ends (for example, cannelloni) or layered, such as lasagne.”

- It would be easy to make the mistake that lasagne is not stuffed and select the incorrect tariff code based on that information, leading to errors in classification.

How technology streamlines food classification

In the face of these challenges, a customs classification solution like TariffTel offers a lifeline for businesses seeking to streamline their food classification processes and achieve greater accuracy with tariff codes. TariffTel acquires essential product characteristics and product data directly from your suppliers and provides an easy-to-use centralised dashboard that guides you in making the correct classification.

TariffTel and food classification

Within TariffTel we have researched and understood the complex terms relating to food products and built our Item Types in a way that is easily understandable for users, removing unnecessary hours of research or accidental misclassification. Food retailers and manufacturers are able to quickly assign tariff codes with precision and confidence. This mitigates the risk of errors and ensures compliance with regulatory requirements.

Unlike other solutions, TariffTel ensures businesses are up-to-date with tariff code updates as soon as they change centrally at the WCO. This key feature is valuable for businesses trying to navigate the complexities of food classification and minimise the risk of custom penalties and shipment delays knowing the codes they use are the very latest.

Whether it’s distinguishing between different types of cheese or determining whether a product is further prepared or not, TariffTel excels in handling the intricacies of food classification and is trusted by leading food retailers to accurately classify a vast range of food products on a daily basis.

Get in touch with our expert team if you are looking for greater accuracy and compliance in your food classification.

Other Useful Resources

Incorrect tariff codes are draining your bottom line

Getting tariff codes right is the fastest way to boost margins Every year, businesses quietly haemorrhage pro...

5 customs classification mistakes that mean fines

Helping high-risk industries avoid expensive errors If your business imports goods - whether electronic compo...

Why technology is essential for food classification

In today's complex trade environment, accurate product classification is more critical than ever for food and drink manu...