Why should classification be considered a strategic business decision?

Topics

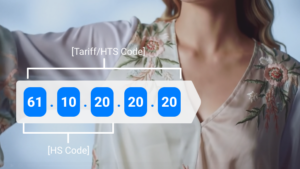

Customs classification is a business-critical decision that not only shapes duty costs, directly impacting profit margins, but is vital to get right if your supply chain is to run smoothly and efficiently. Being compliant with tariff codes means having audit-ready documentation to hand should anything be questioned by customs authorities, HMRC or investors.

Classification is much more than a code.

It’s all too often considered an afterthought, filed under “operations” or handed to brokers without oversight. It’s a crucial part of trade that when done well is not just necessary, but strategic. As recognised by The Food and Drink Exporters Association (FDEA) who recently named TariffTel the Export Service provider of the year acknowledging the crucial role of classification in international trade.

Getting classification wrong can mean customs decisions start triggering multi-million-pound liabilities or impact share prices, as seen in recent cases like ASOS and Morrisons. What we’re seeing today is that classification is no longer just about compliance. It’s about control, cost and credibility.

Whether you’re managing imports, overseeing compliance, or advising on global trade, it’s time to view classification as a key part of your business strategy. In this article, we explain why.

Why should classification be treated strategically?

1. It drives duty costs and commercial margins

The tariff code you assign determines the duties and taxes your business pays. Misclassification can lead to overpayment (cutting into your margins) or underpayment (leading to backdated liabilities and penalties). Classification accuracy directly affects your pricing competitiveness and your bottom line.

The tariff code you assign determines the duties and taxes your business pays. Misclassification can lead to overpayment (cutting into your margins) or underpayment (leading to backdated liabilities and penalties). Classification accuracy directly affects your pricing competitiveness and your bottom line.

2. It exposes or protects you from compliance risk

Customs audits are increasing and classification is one of the first things authorities scrutinise. Without solid justification and documentation, businesses face retrospective duty claims and penalties, all of which can affect your brand’s reputation and credibility. A strategic classification framework reduces this risk and shows regulators and investors that compliance is taken seriously.

3. It influences operational flow and supply chain efficiency

Incorrect classification can trigger customs delays which impact your broader supply chain.

When classification is aligned with accurate product data and real-time regulatory updates, your goods move faster, and your supply chain runs smoother. That’s why TariffTel has built-in automatic alerts which notify you when tariff codes or duty rates change.

Proactive classification management means fewer surprises at the border, and a supply chain that keeps on moving as planned.

Adam Wood, Chief Commercial Officer at Barbourne Brook, a leading customs duty planning consultancy, explains further “Classification is one of the simplest and most overlooked levers for improving margins. When businesses get it right, it becomes a powerful cost-management tool. We routinely see cases where historic misclassification has led to years of unnecessary duty spend, and correcting those errors can unlock significant duty reclaims putting cash back in your bank.

But the real value is in the future. Once the correct codes are embedded, those savings repeat year after year without changing suppliers, renegotiating contracts, or altering the product line. For large importers, that combination of retrospective recovery and long-term savings makes classification one of the most efficient ways to protect profitability and build financial resilience.

That’s why classification deserves board-level attention rather than being seen as a purely operational task. Tools like CAT360 can help businesses quickly understand where they may be over or under-paying and take corrective action with confidence.”

Real-world consequences: ASOS and Morrisons

ASOS: The market reaction

ASOS is currently in a dispute with German customs over how it valued goods for import. While this case centres on valuation, the broader takeaway is that customs issues can escalate quickly into boardroom and investor concerns. ASOS’s internal estimate of potential liability is around €0.5 million, but initial assessments by authorities were in the tens of millions, and the company’s share price dropped over 3% after the news broke. It’s a reminder that customs compliance can move markets.

ASOS is currently in a dispute with German customs over how it valued goods for import. While this case centres on valuation, the broader takeaway is that customs issues can escalate quickly into boardroom and investor concerns. ASOS’s internal estimate of potential liability is around €0.5 million, but initial assessments by authorities were in the tens of millions, and the company’s share price dropped over 3% after the news broke. It’s a reminder that customs compliance can move markets.

Morrisons: A multi-million-pound mistake

UK supermarket Morrisons was found liable for £4.7 million in duties and VAT after incorrectly declaring the origin of aluminium foil as Thailand instead of China. The authorities ruled that the processing in Thailand wasn’t substantial enough to confer origin and therefore anti-dumping duties on Chinese imports applied. This underscores how closely connected classification, origin, and compliance outcomes really are.

Classification is constantly changing

Classification is a constantly moving aspect of trade. When classification is strategic, backed by data, reviewed proactively, and owned by knowledgeable teams, businesses gain:

-Greater margin control

-Lower audit risk

-Faster, more reliable cross-border operations

When done right, classification doesn’t just avoid problems, it drives smarter, more agile trade.

If classification is a priority for you, and you’re keen to see more of how TariffTel’s classification platfom supports businesses with accurate, compliant tariff codes in a few simple clicks, get in touch for a demo.

Other Useful Resources

Tariff Book updates for 2026

As we head into 2026, another round of tariff book changes have come into force. Many relate to electricals and chemical...

How does preparation and packaging impact food and drink tariff codes?

Tariff classification for food and drink products is rarely simple. Exporters dealing with composite goods, processed in...

TariffTel wins at the FDEA Export Awards 2025

We're thrilled to share that TariffTel has been named Export Service Provider of the Year at the FDEA Export Awards 2025...