Manual v. automated classification – what’s best?

Topics

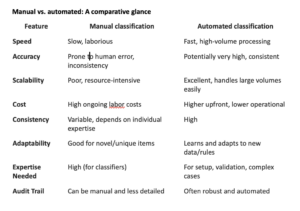

Choosing the right approach to customs classification is a critical decision for any business involved in international trade. The accuracy of this process directly impacts customs duties, compliance and the overall efficiency of your supply chain. Traditionally, this has been a manual task relying on human expertise and managing large amounts of data in spreadsheets, but technological advancements, especially in the age of Artificial Intelligence (AI), have introduced automated solutions which speed up the process and ensure classification is less susceptible to inevitable human error.

Understanding the nuances, benefits and drawbacks of both manual and automated classification, is key here if your goal is to optimise trade operations and ensure accurate and compliant tariff codes for every single product, not just the vast majority of them. Imagine driving across a bridge that only spans 80% of the river. You’d never make it to the other side, in fact, you’d plunge straight into deep water. The same goes for tariff compliance. Missing even 20% of the correct classifications means you’re still putting yourself at risk of audits, fines and held shipments. Near enough is never good enough when the consequences of non-compliance are this serious.

Understanding the nuances, benefits and drawbacks of both manual and automated classification, is key here if your goal is to optimise trade operations and ensure accurate and compliant tariff codes for every single product, not just the vast majority of them. Imagine driving across a bridge that only spans 80% of the river. You’d never make it to the other side, in fact, you’d plunge straight into deep water. The same goes for tariff compliance. Missing even 20% of the correct classifications means you’re still putting yourself at risk of audits, fines and held shipments. Near enough is never good enough when the consequences of non-compliance are this serious.

Manual tariff classification – is it fit for purpose in today’s trading age?

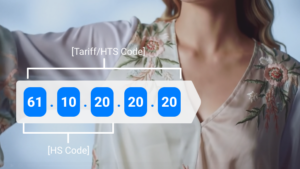

Manual tariff classification involves trade compliance specialists or customs brokers analysing products and assigning the appropriate Harmonised System (HS) codes, usually adding them to a spreadsheet. This process relies heavily on human expertise to interpret product descriptions, consult tariff schedules and apply the General Rules of Interpretation (GRI) – if done well. As codes change frequently, the job of assigning a code doesn’t stop there. Codes need to be monitored and kept up to date and all parties informed, with a clear audit trail available for reporting purposes.

The manual process unpacked (if done well)

– Detailed product analysis: This initial step involves gathering comprehensive information about the product, including its composition, intended use, function, materials, size and unique features.

– Acquiring and understanding HS nomenclature: Specialists use the official HS Nomenclature published by the World Customs Organisation (WCO), which details all categories and codes. Understanding the hierarchical structure (Chapters, Headings, Subheadings) is crucial.

– Analysing HS Chapter: Based on the product’s nature, potential HS Chapters are identified. Chapter Notes, which define inclusions and exclusions, are reviewed carefully.

– Delving into headings and subheadings: Within the identified Chapter(s), the more specific Headings and Subheadings are analysed to narrow down the options.

– Interpreting legal and explanatory notes: Section, Chapter, and Subheading Legal Notes, along with WCO Explanatory Notes, provide critical guidance and clarification for interpretation.

– Applying the general rules of interpretation (GRI): The six GRIs are applied sequentially to determine the correct classification, especially in complex cases.

– Final decision and cross-referencing: An informed decision is made, and it’s often cross-referenced with customs rulings for similar products.

Advantages of manual classification:

– Expertise and nuance: Skilled specialists can interpret ambiguous product descriptions and understand the subtleties of complex regulations that an automated system might miss. They can handle unique situations like new-to-market products or evolving trade laws where predefined rules may not yet exist.

– Customisation and adaptability: Humans can adapt their approach to unique or novel products that don’t fit neatly into existing categories.

– Accountability and justification: Teams can provide detailed explanations and justifications for their classification decisions, which is often essential during customs audits or disputes.

Disadvantages of manual classification:

– Time-consuming and laborious: Manually assigning HS codes, especially for businesses with large and diverse product ranges is a slow and painstaking process.

– Prone to human error and inconsistency: Human interpretation can vary between the people doing the classifying, leading to inconsistent classifications for similar products. Lack of up-to-date knowledge can also result in errors.

– Scalability challenges: As trade volumes increase, manual classification becomes increasingly inefficient and resource-intensive.

– Higher operational costs: Employing and training qualified classification experts can be expensive, particularly for businesses dealing with complex or high-volume transactions.

– Difficulty keeping up with changes: Tariff codes and regulations change frequently due to new trade agreements or regulatory updates, making it challenging for manual processes to stay current.

Automated tariff classification – defining new standards in tariff code accuracy and compliance

Automated tariff classification leverages the latest technology advancements to assign HS codes. These systems, like TariffTel’s customs classification platform, analyse vast datasets, including product descriptions, technical specifications, legal requirements, liaise with your suppliers and recall historical classification data, to determine the most accurate tariff codes. At a fraction of the time (and cost) of doing this manually.

Automated tariff classification leverages the latest technology advancements to assign HS codes. These systems, like TariffTel’s customs classification platform, analyse vast datasets, including product descriptions, technical specifications, legal requirements, liaise with your suppliers and recall historical classification data, to determine the most accurate tariff codes. At a fraction of the time (and cost) of doing this manually.

At TariffTel, we believe automation is the future of customs classification but only when it’s built on the right foundations. The market is rapidly filling with AI-only tools that promise quick fixes, but fall short when precision, context and legal rigour are required. Most AI systems simply mirror the data they’re given. If the original classification is wrong, the AI will confidently repeat that mistake without applying logic, rules or human judgement. TariffTel’s platform takes a different approach. We combine intelligent automation with specialist oversight, blending speed with substance. It’s not just about doing classification faster. It’s about doing it right, every time.

How automated classification systems work to streamline the process

Unlike manual classification, automation brings consistency, structure and control. It removes the risk of human error, ensures every classification follows the same methodology of classification and gives businesses confidence that nothing is slipping through the cracks. With changing regulations, high volumes of products, and increasing scrutiny from customs authorities, automation isn’t just more efficient, it’s a more scalable way to stay compliant.

Additional capabilities like image storage on the TariffTel platform allow product images and documentation to be stored in a centralised location and used for classification and audit purposes. A two-way conversation is enabled between suppliers to request specific product details. This communication is crucial to support the human aspect of interpretation via the TariffTel system.

Advantages of automated classification:

– Speed and efficiency: Automated solutions can classify thousands of products in seconds or minutes, drastically reducing the time compared to manual methods. This is particularly beneficial for businesses with large product catalogues or high shipment volumes.

– Increased accuracy and consistency: Systems like TariffTel deliver high accuracy rates (99% accurate) by minimising human error and ensuring consistent application of classification rules.

– Scalability: Technology solutions can handle increasing volumes of goods without a proportional increase in human resources.

– Cost-effectiveness: By automating the classification process, businesses can reduce operational costs associated with manual classification.

– Real-time adaptability and compliance: Using technology ensures systems can be continuously updated with the latest regulatory changes and historical classification trends, helping businesses stay compliant with current customs regulations without extensive research.

– Improved audit trails: Automated systems can maintain comprehensive logs of classification decisions, providing transparency and accountability for compliance purposes.

Disadvantages and challenges of automated classification including AI classification solutions:

– Initial investment and implementation: Setting up classification systems can require an upfront investment in technology and potentially complex integration with existing enterprise systems (ERP, WMS, etc.). While the long-term efficiencies often outweigh the setup cost, implementation still demands careful planning and change management.

– Data dependency and quality: All automated systems depend on the quality of the data they’re fed. If product descriptions are vague, inconsistent or inaccurate, the system will return flawed classifications. This is especially problematic in AI-only systems that don’t challenge the logic, they simply match patterns. If the wrong code is loaded in, the AI may consider it “accurate” because it matches the original, not because it’s actually correct. The output reflects the input. Faulty data in means faulty compliance out.

– Lack of interpretive intelligence in AI: Purely AI classification tools are typically pattern-matching systems. They don’t apply tariff logic, interpret General Rules of Interpretation (GRIs), or make judgement calls based on evolving regulatory nuance. Instead, they default to what looks “most similar”, a risky approach when classification requires critical thinking, not repetition. This makes AI-only systems flawed when faced with grey areas or complex cases. Human interpretation will win out.

– Handling novelty: Because AI systems are trained on historical datasets, they often underperform when dealing with new, innovative, or previously unseen products. If the product doesn’t exist in the training data, the system lacks the context to make a sound classification, increasing the risk of errors or delays.

– Human oversight isn’t optional, it’s essential: Automated tools can process large volumes quickly, but classification is rarely black and white. Complex, ambiguous, or high-risk products require expert judgment. That’s where TariffTel stands apart. Our system isn’t just automated, t’s built by classification specialists, and backed by hands-on human support. We bridge the gap between automation and expertise, ensuring decisions are technically correct.

– Bias in AI: If the training data for an AI-only system contains historical biases, the AI system may perpetuate them. Without rigorous data governance and validation, bias becomes embedded creating compliance risks that go unnoticed until it’s too late.

The rise of hybrid classification models like TariffTel

Recognising the strengths and weaknesses of both approaches, many organisations are moving towards hybrid models. These models, spearheaded by TariffTel, combine the speed and efficiency of automation with the nuanced understanding and oversight of human experts to transform classification.

Taking this approach works:

Taking this approach works:

-An automated system handles the bulk classification of straightforward products.

-Tariff code changes and regulatory updates affecting codes are automatically and instantly updated on the system.

-Full reporting and audit trail functionality makes compliance simple.

-Human experts focus on complex, ambiguous, or new products. Especially useful for the food and drink sector where products can notorious hard to classify.

-Experts review and validate automated classifications, especially those with high-risk or high-value implications.

-This approach aims to maximise accuracy and efficiency while minimising costs and risks.

Conclusion: Choosing the right approach to classification

The decision between manual, automated, AI or a hybrid approach to tariff classification depends on a company’s specific circumstances, including the volume and complexity of its products, its risk tolerance, available resources and long-term strategic goals.

Manual classification, while offering deep expertise for niche situations, is increasingly challenged by the scale and pace of modern global trade. Automation presents a compelling solution for enhancing speed, accuracy and efficiency, but it requires careful implementation, quality data, and continued human oversight. When accuracy is the goal, AI solutions today can only take you part of the way there. Think back to making it only part way across a bridge.

For many businesses, a hybrid model like TariffTel will likely offer the most robust, compliant, and cost-effective path forward. As technology continues to advance, the trend towards greater automation and data-driven decision-making in trade compliance is set to accelerate. Having a system in place that will scale as your business expands is crucial, especially as the risks and costs associated with non-compliance will only get greater.

Want to know more about our platform? Get in touch with our team for a demo.

Other Useful Resources

“We’ve always used this code. Why would we change it?”

That question is costing you more than you think. It sounds reasonable. The code worked last time. Your broke...

Why 2 out of every 5 tariff codes are typically wrong

And what it’s costing you... Tariff codes might look like a routine administrative step when you’re preparing goo...

Tariff Book updates for 2026

As we head into 2026, another round of tariff book changes have come into force. Many relate to electricals and chemical...