What is a HTS code? A guide UK guide for trading with the US

Topics

When tariffs are in a state of flux and trade policies are shifting, understanding the details of customs classification puts you at a competitive advantage.

If you’re a UK-based business importing or exporting goods into the US, you’ve likely come across terms like HTS code, HS code, commodity code or tariff classification. And while they may all sound similar, they’re not interchangeable. In fact, misunderstanding the difference could cost you in more ways than you realise.

Here, we look at the differences between the different codes, their components and delve into some of the challenges businesses face when trading with the US today.

What is a HTS code?

A HTS code (Harmonised Tariff Schedule code) is the US system which holds the codes importers must provide on their customs declarations to Customs and Border Protection (CBP) to determine duty and tax liabilities on imported goods.

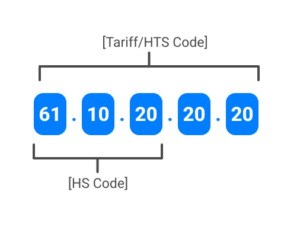

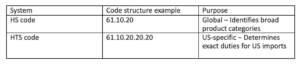

The HTS is based on the global Harmonised System (HS) developed by the World Customs Organisation (WCO). The first six digits of any HTS code are aligned globally under HS rules. But the HTS adds extra digits specific to the United States – extending codes to 8 or 10 digits to apply US-specific tariffs and regulations. It is worth noting that each country maintains its own Harmonised Tariff Schedule (or similarly named).

The HTS is based on the global Harmonised System (HS) developed by the World Customs Organisation (WCO). The first six digits of any HTS code are aligned globally under HS rules. But the HTS adds extra digits specific to the United States – extending codes to 8 or 10 digits to apply US-specific tariffs and regulations. It is worth noting that each country maintains its own Harmonised Tariff Schedule (or similarly named).

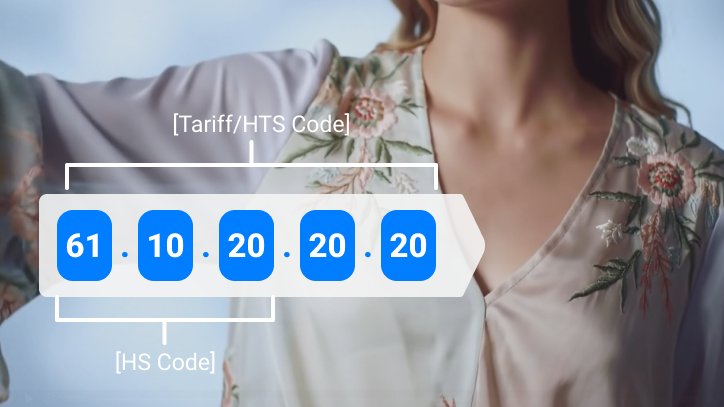

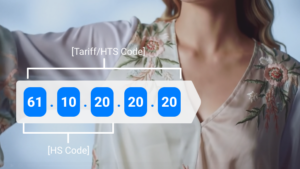

As an example:

Chapter: The first two digits of the HS code represent the chapter, which broadly categorises goods into overarching groups. There are 99 chapters in total, each covering a specific range of products. For example, Chapter 61 covers “articles of apparel and clothing accessories, knitted or crocheted”.

Chapter: The first two digits of the HS code represent the chapter, which broadly categorises goods into overarching groups. There are 99 chapters in total, each covering a specific range of products. For example, Chapter 61 covers “articles of apparel and clothing accessories, knitted or crocheted”.

Heading: The next two digits further specify the product within a chapter and are known as the heading. This level of classification provides more detail about the type of goods. Following the example above, Heading 6110 provides for “sweaters, pullovers, sweatshirts, waistcoats (vests) and similar articles, knitted or crocheted”.

Subheading: The subheading provides the next level of precision and will be used differently depending on the area of the tariff. Using our example, Subheading 6110.20 is dedicated to “sweaters, pullovers, sweatshirts, waistcoats (vests) and similar articles, knitted or crocheted, made of cotton”. This subheading provides a vehicle to break out products made of different materials.

Legal Tariff Rates: These next digits provide the actual tariff rates for the classification, as well as a further breakdown of specific material composition. 6110.20.20 provides for the products previously mentioned, made of cotton, which do not contain 36% or more by weight of flax fibers. Our example is 100% cotton, which meets that description and therefore receives a duty rate of 16.5%.

Statistical Suffix: The final two digits in the HTSUS is for statistical reporting purposes, used for trade-data collection. 6110.20.20.20 is our full 10 digit tariff code which meets our product description; “sweaters, pullovers, sweatshirts, waistcoats (vests) and similar articles, knitted or crocheted, made of cotton, not containing 36% or more by weight of flax fibers, Sweaters, Women’s”. It is worth being aware that the statistical suffixes often include terminology which has specific definitions and rules to be aware of. For example, “Sweaters” may seem innocuous, but there is a specific stitch-count requirement which must be met to be classified here.

Common challenge: Using the right codes for the country of import

Most UK companies will be aware that they need a commodity code to ship internationally. However, the mistake that some will make is to assume that the same code will work regardless of the country that they are importing into.

Here’s where things can get tricky. Each country has their own tariff book and while they generally align up to 6 digits, after that it is up to the country how much further they want to change the layout. This is especially true for HTSUS which generally goes into much more detail than other countries, as well as having their own terminology which can create unexpected classification errors, leading to:

-Higher-than-expected duties

-Customs delays

-Penalties for misclassification

-Missed opportunities for duty reductions

When is a Blouse a Blouse?

There are many rules and requirements about where certain items should be classified in which area of the tariff. Depending on the products these can be multifaceted and complex, and classifying in the wrong place can lead importers to over or underpay on their duty obligations.

Take a standard woven blouse made of 100% cotton. Generally, these are classifiable in heading 6206 “Women’s or girls’ blouses, shirts and shirt-blouses”. However, if you were to add pockets below the waist of the garment or add a means of tightening at the bottom of the garment, then it would be excluded from 6206 and fall instead to 6211.

-Women’s woven cotton blouse: HTS code 6206.30.30 – Duty 15.4%

-Women’s woven cotton blouse: HTS code 6206.30.30 – Duty 15.4%

-Women’s woven cotton blouse: HTS code 6211.42.10 – Duty 8.1%

As you can see the difference in duty is sizeable for such a small change to the product. This is just one example of misclassification potentially doubling your duty liability.

Recent US trade tariff changes

Under current US trade policy, including Trump-era tariffs and country-specific duty hikes (e.g. on Chinese or EU-origin goods), businesses face:

-General baseline tariffs of 10% or more on many goods, including goods from the UK

-Broad, sweeping tariffs as high as 50% depending on origin

-The ending of the de minimis treatment for Chinese and Hong Kong origin shipments (predominantly ecommerce) from May 2nd. Alongside the ending of this exemption for the rest of the world once the US system is in place.

-A marked increase in audits from Customs Border Protection on imports into the US to ensure tariff regulation compliance.

With these stakes, correct HTS classification is essential not just for compliance, but for cost management and trade strategy.

How to classify HTS codes correctly

Mastering HTS classification takes more than consulting the tariff book. Best practice includes:

-Using complete and accurate product specifications: materials, use, construction, composition

-Understanding US-specific terminology and product naming

-Classifying according to the General Rules of Interpretation (GRIs) and Customs Rulings

-Understanding product specific inclusions and exclusions from certain chapters/headings within the tariff by reading the Explanatory Notes and US classification guidance (ICP guides and webinars).

-Leveraging a digital tool (like TariffTel‘s customs classification platform) to automate and assign accurate tariff codes every time

-Auditing classifications regularly – especially if your supply chain or product descriptions change.

-Keeping abreast of changes to the tariff and updating classifications as needed.

-In an unpredictable tariff environment, accurate classification equals compliance and means you are taking important steps to safeguard your business from potential fines and shipment delays due to misclassification.

Whether you’re new to US importing or want to ensure your current classifications are accurate, we’re here to help. Get in touch to hear how we support businesses in trading with the US.