Christmas classification confusion: Navigating conflicting tariff notes

Topics

Businesses classifying festive goods in the UK and EU this season are facing an unusual classification challenge, a misalignment between updated World Customs Organisation (WCO) guidance for Chapter 9505 and the currently unchanged EU and UK Chapter Notes. While it’s not unusual for the WCO Explanatory Notes to be updated ahead of domestic alignment, this timing, coinciding with peak seasonal imports, has made classifying seasonal products more complicated and caused some confusion.

Here’s what we know about the current position and how we’re supporting customers.

Christmas products: The Explanatory Notes update

In June, the WCO revised the Explanatory Notes for 9505 to expand the definition of “articles of Christmas.” The revised text now states that 9505 includes figurines or hanging decorations with Christmas-related symbols, mainly used during Christmas but not designed to be hung on a Christmas Tree, such as:

Decorative figurines holding candy canes

Decorative figurines with clothing or accessories, which have the colours, design or shape resembling those of Father Christmas. This broader interpretation, while not legally binding, could influence how customs authorities classify goods ahead of Christmas. If applied, it may expand the number of products eligible for classification under 9505, which typically attracts lower duty rates compared to alternative headings. For example, in the UK, products classified under 9505.10.90 attract a 2% duty rate, whereas similar items classified under heading 3926 may face a 6% duty rate.

Currently, the UK and EU Chapter Notes have not been updated to reflect the change in the WCO Explanatory Notes for heading 9505, and businesses are facing uncertainty as they wait to see if, and when, the Chapter Notes will be updated to reflect these revisions.

Why is there conflict between the current EU and UK Chapter Notes and the WCO Explanatory Notes?

Under the current legally binding Chapter Notes to Heading 9505, subheading 9505.10 will only incorporate products which have a longstanding association with the tradition of Christmas. Products with a general winter theme, such as snowmen, reindeer, or icicles, are not included under this heading even if the colours, outfits or design suggest a connection with Christmas.

The result is a significant conflict between interpretative guidance and binding law.

Example: A robin in a Santa outfit

This example takes the case of a decorative robin wearing a Santa jacket and hat. The one shown is from M&S.

Under the UK and EU Chapter Notes, this product would fall outside 9505, as it is considered a seasonal winter decoration rather than an article “recognised as being used at Christmas festivities due to long standing national traditions”. Under the new WCO Explanatory Notes, the same item would be included in 9505, as it is clearly wearing clothing which has the “colour, design and shape resembling those of Father Christmas. The differences in these two methods means that businesses could arrive at two different classification outcomes, with reasonable justification. However, it’s important to remember that only the position set out in the Chapter Notes is legally binding.

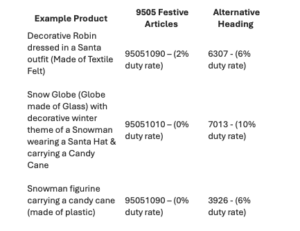

Duty rate impact: Festive vs. alternative headings

The financial implications of this misalignment could be significant for many businesses looking to plan for the Christmas retail period. Classifications under 9505 usually provide access to lower or even zero duty rates compared with alternative headings. Here’s a few examples.

Implications for importers

Until the Chapter Notes and WCO Explanatory Notes are formally aligned, businesses should exercise caution in classifying Christmas Decorations.

This situation has two main implications:

1. No access to lower duty rates: Importers are unable to benefit from the generally lower duty rates which apply to 9505 festive articles classifiable under the new WCO

2. Ongoing uncertainty for seasonal product ranges: Businesses preparing their Christmas sourcing for 2026, may want to hold off confirming their classification decisions which impact duty rates, landed costs and profit margins. Unless the legally binding Chapter Notes are updated, products will remain subject to generally higher duty rates.

While it remains uncertain if or when the Chapter Notes will be revised to align with the updated WCO Explanatory Notes, alignment is generally expected based on past practice. Until then, many businesses will need to monitor the situation closely.

We recommend that businesses carefully document and track any products that could be reclassified if the Chapter Notes change, so reclassification and potential access to lower duty rates can be applied. Finally, keep a close watch on official announcements. Any update aligning Chapter Notes with the new Explanatory Notes may have immediate implications for tariff treatment and should be acted on promptly.

Caught up in Christmas confusion? If you’re classifying Christmas and seasonal goods and in need of support, get in touch with our team to see how we’re getting businesses Christmas-ready for 2025.

Other Useful Resources

TariffTel is now ISO 27001 certified

Your product data, protected to the highest standard. We’ve achieved ISO/IEC 27001:2022 certification, the internat...

“We’ve always used this code. Why would we change it?”

That question is costing you more than you think. It sounds reasonable. The code worked last time. Your broke...

Why 2 out of every 5 tariff codes are typically wrong

And what it’s costing you... Tariff codes might look like a routine administrative step when you’re preparing goo...