Blog

Blog

Incorrect tariff codes are draining your bottom line

Getting tariff codes right is the fastest way to boost margins Every year, businesses quietly haemo...

5 customs classification mistakes that can get your business fined

Helping high-risk industries avoid expensive errors If your business imports goods - whether electr...

Why technology is essential for food and drink classification

In today's complex trade environment, accurate product classification is more critical than ever for food and ...

Customs audits are coming. Is your business ready?

The UK government has signalled a serious shift in customs enforcement. With the 2024 Autumn Budget announcing...

Manual v. automated classification and the value of a hybrid approach

Choosing the right approach to customs classification is a critical decision for any business involved in inte...

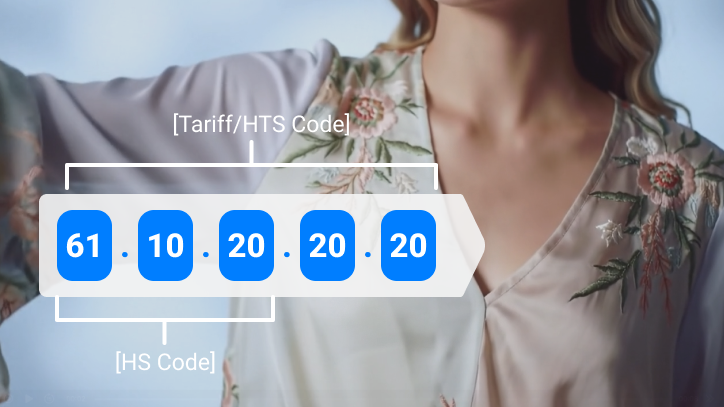

What is a HTS code? A guide for UK businesses trading with the US

When tariffs are in a state of flux and trade policies are shifting, understanding the details of customs clas...

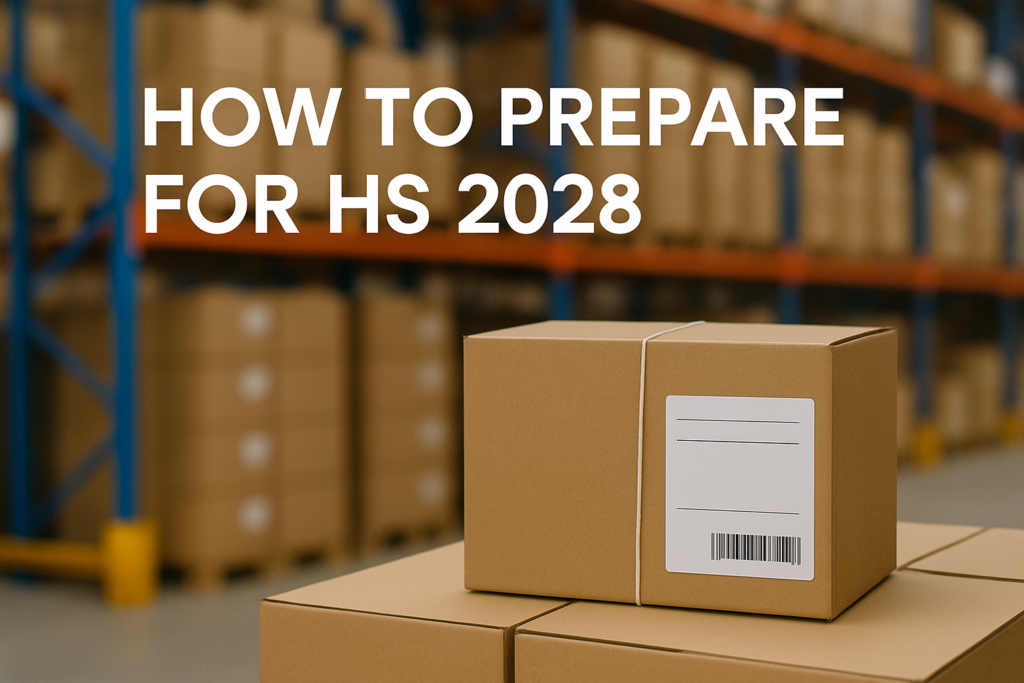

HS 2028: Your guide to the next harmonised system update

It may seem a while off yet, but the wheels are already in motion to make changes to the harmonised system, th...

Do customs brokers ensure tariff code compliance?

Customs brokers have long been essential partners for businesses operating in the complex world of internation...

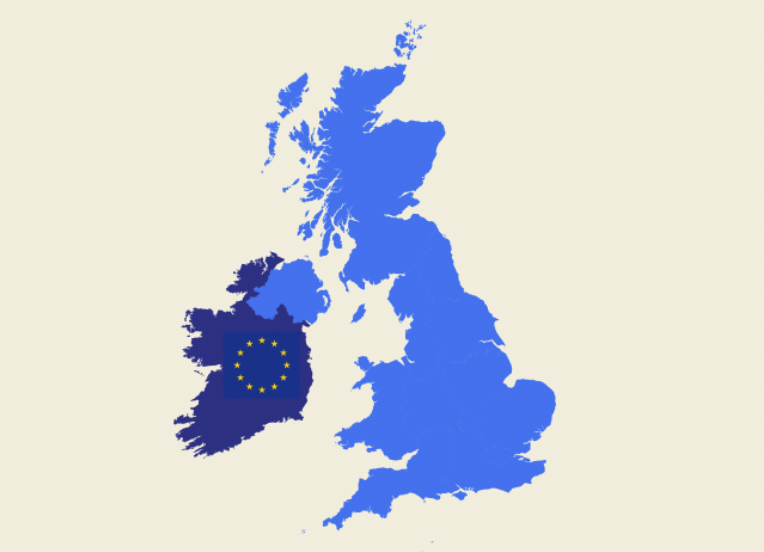

Windsor Framework update: Key details ahead of 1st May 2025 implementation

The Windsor Framework's latest updates come into effect on 1st May 2025, introducing new trading arrangements ...

From spreadsheet chaos to smart compliance

Data accuracy matters more than you think in customs classification. In global trade, the difference betwee...